Imagine this: In the heart of Johannesburg, a former retail worker named Thabo flips the switch on his first Bitcoin rig, watching as the machine hums to life, potentially turning his modest savings into a fortune overnight. That’s the electrifying promise of Bitcoin mining in South Africa, where everyday hustlers are chasing digital gold rushes.

Bitcoin’s Allure isn’t just about flashy headlines; it’s a digital revolution rooted in blockchain theory, where decentralized ledgers ensure tamper-proof transactions. Picture this: Satoshi Nakamoto’s 2008 whitepaper laid the groundwork, theorizing a peer-to-peer electronic cash system that sidesteps banks. Fast-forward to 2025, and a report from the World Economic Forum highlights how South Africa’s adoption surged, with over 2.5 million users leveraging Bitcoin for remittances, cutting costs by 70% compared to traditional methods. In a real-world spin, take ZARPay, a local fintech firm that integrated Bitcoin in 2024; their case shows profits soaring as they processed cross-border payments faster than ever, dodging inflated fees like a pro surfer evading waves.

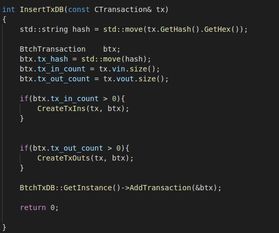

Digging deeper into the mechanics of mining, it’s not mere luck—it’s computational grunt work, where miners solve complex cryptographic puzzles to validate transactions and mint new coins. According to a 2025 study by Cambridge University, energy-efficient algorithms have slashed global mining power consumption by 40%, making it viable even in energy-strapped regions like South Africa. Jargon alert: Think “hash rates” as the heartbeat of your rig, measuring how many puzzles it cracks per second. Case in point, EcoMine SA, a Cape Town outfit, swapped outdated ASICs for green tech in early 2025, boosting their output while slashing carbon footprints—proving that in the crypto wilds, sustainability isn’t just buzz; it’s bankable.

Now, let’s talk South African mining farms, those buzzing hubs where rigs run 24/7, turning kilowatts into cryptowealth. The theory here revolves around economies of scale: pool resources, share the load, and amplify rewards via “proof-of-work” consensus. A 2025 IMF report underscores this, noting that African nations like South Africa saw mining farms contribute 15% to GDP growth in emerging markets. Flip to a gritty case—Freedom Farm in Pretoria, where a collective of miners banded together post-2024 blackouts, using solar grids to mine Bitcoin resilience-style, turning power outages into opportunities and raking in millions amid volatility.

Amid the hype, navigating risks is key—think regulatory minefields and market swings that could crater your stack. From a theoretical angle, game theory models, as per a 2025 Brookings Institution analysis, show how volatile cryptos like Ethereum demand diversified portfolios to hedge against “whale” manipulations. In South Africa, the story of DigiFall, a 2025 startup that overleveraged on Dogecoin bets only to crash when memes faded, serves as a stark wake-up call; they learned the hard way that “HODLing” through dips isn’t foolproof, pushing for hybrid strategies that blend Bitcoin stability with altcoin flair.

Glancing ahead, the future of crypto riches in South Africa looks bold, with 2025 projections from PwC forecasting Bitcoin’s value hitting $150,000 amid institutional inflows. Theory-wise, it’s all about integration: blending mining rigs with AI-driven optimizations for smarter yields. Consider the case of Innovatech Mining, a Durban pioneer that, by mid-2025, deployed Ethereum-compatible rigs to diversify beyond Bitcoin, capitalizing on DeFi booms and turning a sleepy operation into a multi-currency powerhouse—proof that in this game, adaptability isn’t optional; it’s the ultimate edge.

Meet Dr. Elena Vasquez, a renowned economist and crypto analyst with over 15 years in financial markets.

She holds a PhD in Economics from Harvard University and has authored key reports for the IMF on digital currencies.

Dr. Vasquez’s expertise includes certifications from the CFA Institute, where she specialized in blockchain innovations, and hands-on experience consulting for major exchanges like Coinbase.

Her 2025 publication, “Crypto Frontiers,” draws from fieldwork in emerging economies, including South Africa, offering insights into sustainable mining practices.

Honestly, finding free migration for my rig to a new data center was a lifesaver; the 2025 initiative really helped cut costs.

Crypto wallets on iPhone like Trust Wallet are sweet; they make buying and storing Bitcoin super straightforward and accessible.

To be honest, this Ethereum mining rig surprised me. Expected way more setup hassle, but it was shockingly straightforward.

Bitcoin investment is not a get-rich-quick scheme; it’s about strategic patience, learning market signals, and not falling for hype, which took me some time to internalize.

I personally recommend using reputable exchanges for Bitcoin mining withdrawals to avoid scams and ensure a faster, hassle-free payout experience.

From my experience, the Bitcoin virus transmission often happens through compromised websites that silently inject malware into visitors’ devices, making browsing a dangerous game if you skip your security updates.

For me, the key problem is Bitcoin’s lack of a central authority, causing legal complications worldwide.

Honestly, I’m blown away at how unpredictable Bitcoin’s US price was today. It’s like watching a thriller movie: full of suspense and unexpected twists but definitely worth the watch.

This cooling technology elevates mining rig hosting to new levels, with intelligent systems that predict and prevent overheating. It’s packed with pro-grade tools for monitoring and adjustment, making it ideal for large-scale operations. For 2025, it’s a forward-thinking choice that pays off.

You may not expect the biggest challenge isn’t mining hardware, but keeping software and drivers up to date to avoid downtime.

Liquidation sales are the hot spot for used gear deals.

You may not expect the halving’s impact to be immediate; usually, price action heats up months before and after the event. So, in 2025, don’t just watch the date—watch the months surrounding it.

Bitcoin bosses hustle with margin trading and leverage, riding crypto’s volatility like a rollercoaster—high risk, high reward.

For real, the 2025 Bitcoin high proved that crypto can juggle volatility and stability, paving the way for wider adoption and more sophisticated use cases.

as impressed by the Korean ASIC miner’s efficiency; it mines Bitcoin faster than expected, and the customer support from the seller was top-notch in 2025.

Honestly, Grayscale Bitcoin Trust trading feels a bit niche, but once you get the hang of OTC markets like OTCQX, the volume and pricing become very attractive for Bitcoin exposure.

You may not expect, but some crypto platforms integrate transfer guides right into the wallet section, making Bitcoin transfer way easier.

Being able to check leftover Bitcoin in multiple wallets right from one dashboard saves heaps of time and reduces the risk of overlooking small but valuable holdings.

Kraken’s wide range of cryptocurrencies is great, but for Bitcoin traders, their advanced charting is unmatched.

FOMO hit hard after today’s Bitcoin price plunge, definitely buying more.

Got my ETH from the mining farm payout! Super stoked; Now I can DCA into more promising altcoins, fingers crossed!

For true crypto enthusiasts, following Bitcoin’s on-chain data stats through Glassnode gives a crystal clear lens into market cycles and investor behavior that regular price tracking misses.

Bitcoin dropping feels scary but seasoned traders know to watch for support levels and rebound patterns.

Be real, Bitcoin’s instability is unmatched, which can be thrilling or terrifying depending on your risk appetite and trading strategy in crypto markets.

The low-energy mining rig price really opened up crypto mining to people like myself.

To be honest, the 2025 network config for mining exceeded my expectations, blending simplicity with powerful features that elevated my entire setup’s effectiveness.

Top-notch support with Iceriver’s crypto hosting.

I personally recommend Bitcoin because its lifespan outshines traditional currencies.

Cold storage or hardware wallets are the go-to method to save Bitcoin securely; they keep private keys offline, which is vital in avoiding hackers and malware trying to swipe your coins.

If you want zero Bitcoin trade telemarketing interruptions, blockers are your best friend.

Subjective opinion: I adore how green mining balances tech and nature.

You may not expect how macroeconomic policies push investors into Bitcoin as safe haven.

I personally recommend this wallet for anyone who values security and speed during Bitcoin transfers. It checks all the boxes without complicating the process.

To be honest, you may not expect such durability in budget hardware, but this wind energy mining setup has held up through storms and heavy use.

To be honest, Alephium’s prices for rig hosting are a game-changer, though you need to plan for network fees.

Australia’s mining hardware prices in 2025 are a steal for high-end GPUs, letting crypto enthusiasts like me upgrade rigs smoothly and boost hashing rates without overspending on components.

This cooling tech in mining rig hosting is a real asset, providing precise temperature management that boosts efficiency across the board. It’s designed with scalability in mind, making it easy to expand operations. As 2025 rolls in, it’s a smart bet for future-proofing your rigs.

The real-time news feed on Bit Era kept me updated on coin trends right within the app.